Vancouver, British Columbia, December 14th, 2023 – Xcite Resources Inc. (“XRI”: CSE, or Xcite) entered

into six individual option agreements with Eagle Plains Resources Ltd. (“EPL”: TSX-V, or “Eagle Plains”),

whereby Xcite may earn up to an 80% interest in six uranium projects totaling 5905 hectares in close

proximity to Uranium City in northern Saskatchewan.

Chris Cooper, Xcite’s Chairman of the Board commented, “We are pleased to enter the world’s best

uranium district with a premier portfolio of properties that have demonstrated high-grade surface

showings with a strong potential for a world-class discovery. This transaction will lead us to the forefront

of the energy metal arena and allow our shareholders to capitalize on the emerging uranium market.”

Tim Termuende, P.Geo. President and CEO of Eagle Plains commented, “We are excited to partner with

Xcite to accelerate the exploration of the Uranium City projects. Considering the rich production history

of many of the individual projects, we welcome the opportunity to conduct modern exploration methods

combined with continually advancing geological understanding of the genesis and controls of uranium

mineralization known to exist there.”

Athabasca Basin History and Mineralization

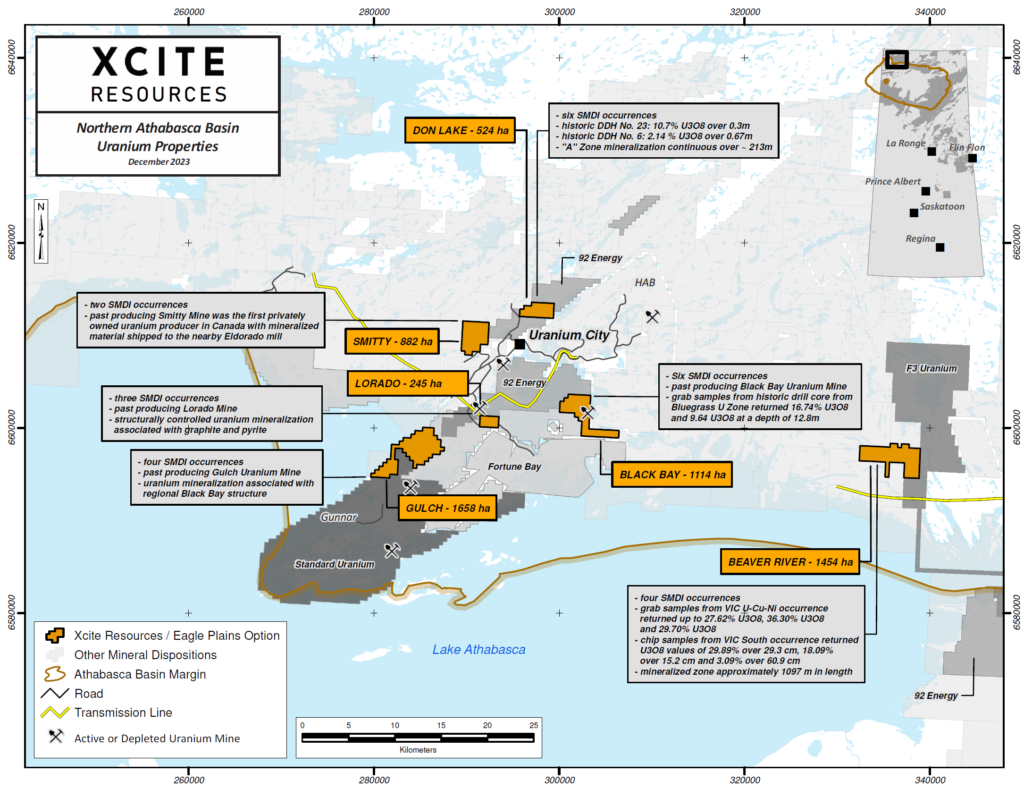

The Beaver River, Black Bay, Don Lake, Gulch, Larado, and Smitty projects are located in the Beaverlodge

District near Uranium City in the Lake Athabasca region of Saskatchewan. Occurrences of uranium

mineralization are abundant in the region and have been explored and documented since the 1940s. The

Beaverlodge camp was the first uranium producer in Canada, with historic production of approximately

70.25 million pounds of U3O8 between 1950-1982, from ore averaging 0.23% U3O8. The two largest

producers were the Eldorado Beaverlodge (Ace-Fay-Verna) and the Gunnar uranium mine. Since the early

90’s, limited uranium exploration work has been conducted in the Beaverlodge area.

Xcite Resources’ management cautions that past results or discoveries on proximate land are not

necessarily indicative of the results that may be achieved on the subject properties.

Beaverlodge-style uranium deposits host structurally controlled, high-grade mineralization in veins and

breccia fills within basement rocks. Mineralization often occurs at geological contacts and consists of

structures filled with hematite, chlorite, and graphite associated with pitchblende (an ore mineral of

uranium).

Athabasca Basin Project Summaries

Beaver River (1455 ha)

- Four Saskatchewan Mineral Deposit Index (“SMDI”) occurrences.

- Grab samples from VIC U-Cu-Ni occurrence (SMDI 1553) returned from trace values up to 27.62%

U3O8, 36.30% U3O8 and 29.70% U3O8 (AF 74O05-0051); mineralized zone approximately 1097m in

length (AF 74O05-0066). - Rock chip samples at SMDI 1994, 800m southeast of VIC occurrence, returned U3O8 values of

29.89% over 29.2cm, 18.09% over 15.2 cm and 3.09% over 60.9 cm (AF 74O05-0077).

Black Bay (1114 ha)

- Six SMDI occurrences.

- Black Bay Uranium Mine (SMDI 1296) discovered in 1953; mineralization developed in three main

shoots discovered along a strike length of approximately 152.4m (500’) and a down-dip distance

of 731.5m (2400’); 1355 tons produced at 0.17% U3O8. - Grab samples from the drill core at Bluegrass U Zone (SMDI 1295), located 600m northwest of

Black Bay Mine, returned 16.74% U3O8 and 9.64% U3O8 at a depth of 12.8m.

Don Lake (524 ha)

- Six Saskatchewan Mineral Deposit Index (“SMDI”) occurrences.

- Discovered in 1950 by Eldorado Mining and Refining.

- Drilling at Don Lake A, B, and C Zones (SMDI 1393) returned values of 10.7% U3O8 over 0.3m in

- DDH No. 23 and 2.14% U3O8 over 0.67m in DDH No.6 from a sheared and brecciated granite (AF

- 74N10-0422).

- Zone mineralization continuous over approximately 213m.

Gulch (1685 ha)

- 20 km SW of Uranium City.

- Four SMDI occurrences.

- Uranium mineralization associated with the regional Black Bay structure.

- 1953-57 underground development at Gulch Uranium Mine (SMDI 1221) outlined 11 mineralized shoots.

- 1954 trenching at Lucy (SMDI 1223) returned values from below detection to up to 0.37% U 3O8 over 3m.

- Duvex Oils and Mines Radioactive Zones (SMDI 1224) grab samples returned values from trace up to 2.23% U3O8.

- Last documented work in 2015 concluded that anomalous U mineralization was structurally controlled similar to the past-producing Gulch uranium mine and further work, including deeper drilling, was recommended for the property.

Larado (245 ha)

- 10km S of Uranium City along Saskatchewan Provincial Highway 962.

- 3 SMDI occurrences.

- Larado Uranium Mine (SMDI 1228) saw extensive underground development and production from 1953-1960; structurally controlled uranium mineralization associated with graphite and pyrite.

- Pitchie Uranium Zone (SMDI 1229) is located 850m southwest of the Larado Mine; main zone uranium mineralization exposed on the surface for 91m; historical work includes approximately 50 diamond drill holes, the majority of which were less than 100m in length.

Smitty (849 ha)

- 2 SMDI occurrences.

- In 1954 became the first privately owned uranium producer in Canada with mineralized material shipped to the nearby Eldorado mill.

Rock grab samples are selective samples by nature and as such are not necessarily representative of the

mineralization hosted across the property.

The above results were taken directly from the SMDI descriptions and assessment reports filed with the

Saskatchewan government. Management cautions that historical results were collected and reported

by past operators and have not been verified nor confirmed by a Qualified Person, but form a basis for

ongoing work on the subject properties. Management cautions that past results or discoveries on

proximate land are not necessarily indicative of the results that may be achieved on the subject

properties.

Under the terms of the agreement, Xcite may earn an 80% interest in each individual property by

completing CDN$3,200,000 in exploration expenditures, issuing 750,000 common shares of Xcite and

making cash payments to Eagle Plains of CDN$55,000 over four years. Upon Xcite fulfilling the terms of

any or all of the earn-in agreements, an 80/20 joint venture will be formed, with Eagle Plains retaining a

carried interest in all expenditures until delivery by Xcite or its assigns of a bankable feasibility study.

During the option earn-in period, XRI will be appointed as operator, and EPL will manage the exploration

programs under the direction of a joint technical committee. The projects are owned 100% by EPL, who

will retain an underlying 2% NSR royalty on each of the properties.

Qualified Person

The technical information in this News Release has been reviewed and approved by C.C. Downie, P.Geo.,

a director and officer of Eagle Plains, hereby identified as the “Qualified Person” under N.I. 43-101.

Cautionary Note Regarding Forward-Looking Statements

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward-looking statements including but not limited to comments

regarding the timing and content of upcoming work programs, geological interpretations, receipt of

property titles, potential mineral recovery processes, etc. Forward-looking statements address future

events and conditions and therefore, involve inherent risks and uncertainties. Actual results may differ

materially from those currently anticipated in such statements.